The only explanation of income-producing investments you need

In a world where we are confronted with the lowest interest rates since the 1950s, trying to obtain sufficient income from cash and fixed interest investments, such as term deposits, is a difficult proposition. The official ‘cash rate’ is set by the Reserve Bank of Australia (RBA) and currently sits at 0.75 per cent.

The interest rate offered on longer-term deposits is impacted by this rate. The average of term deposit rates available is less than 2 per cent, even if you are prepared to invest your money for five years or more.

The chart below shows the dramatic changes in short-term interest rates in Australia since 1990. In particular, you should note the blue line at the bottom that shows the cash rate after deducting inflation. This is known as the ‘real cash rate’. You can see that at present this rate is below zero.

If you are also paying tax on your interest earnings, the situation gets worse. Therefore, after tax and inflation, leaving money in cash and short-term deposits guarantees you will go backwards in real terms.

These circumstances could persist for many years to come both in Australia and overseas. Accordingly, even conservative investors are looking for income in places other than cash and term deposits. So, what are the choices and what are the risks?

For Australian investors, income can be derived from investments in a number of different asset classes. It is important to understand that the different asset classes have different characteristics, particularly when it comes to the amount of risk.

The asset class and risk relationship

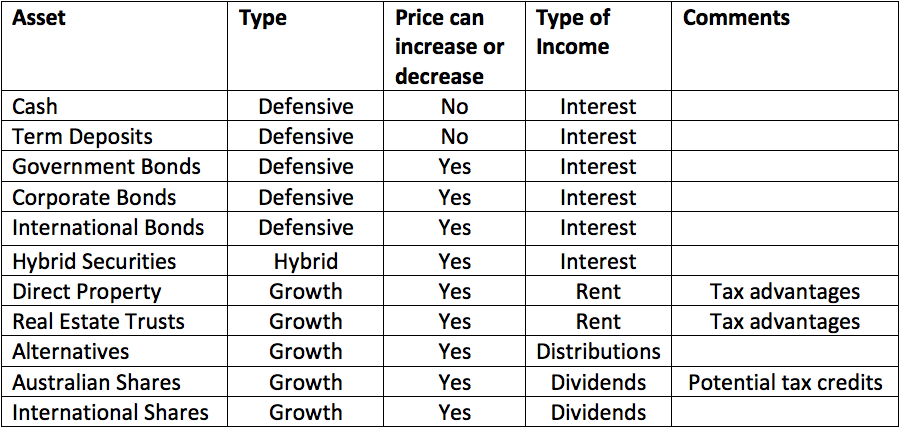

An asset class is a category of investments that have similar characteristics. In simple terms, risk is chance that the price of the asset could fall (sometimes dramatically) in the future. Over time, investors are generally rewarded by taking this extra risk by obtaining a higher return either in income or in increases in the price of the asset. Generally, the asset classes can be categorised as defensive or growth assets as follows:

Sources of investment return

The table above illustrates that as you move from left to right, the expected risk increases and so does the potential return. But where do these returns come from for each of these assets?

This is set out in the table below which can be quite helpful in determining where you might look for income and how much risk you are taking to get it.

Cash, term deposits and government bonds

There are many ways that you can access these different asset classes both directly and indirectly, but I have focused here on the major categories. The important thing to note is that there are really only two asset classes where there is no risk of prices changing and those are cash and (government-guaranteed) term deposits.

The problem, of course, is that the price being paid for this security of investment is a very low interest rate.

It is further interesting to note that government bonds, both in Australia and overseas, can be subject to price increases and decreases.

This sounds perverse given that they are backed by large governments. However, the price of these securities can change as interest rates change. As interest rates fall, the price of bonds will typically increase and conversely as interest rates increase, the price of bonds will fall.

At the moment, with interest rates at very low levels globally, the risks of owning bonds is relatively high if you feel that interest rates will eventually recover and go back up. Also, the prevailing interest rates available for purchasing government bonds is extraordinarily low.

In Australia the current 10-year government bond interest rate is around 1 per cent. If interest rates were to increase to 1.5 per cent, the price of a bond could fall by up to 50 per cent.

Sovereign bonds

So, what about international government bonds, which are sometimes referred to as sovereign bonds?

The situation here is similar to Australian government bonds except there is an additional risk in relation to adverse movements in the Australian dollar versus the currency of the country in which you are buying the bond. In relative terms, as the Australian dollar increases the value of your overseas investment falls and vice versa.

This same problem of course applies to overseas shares. You can arrange to ‘hedge’ against the risk of adverse currency movements, however, this hedging has a cost that will reduce an already low yield.

There is also an additional problem known as ‘credit risk’. This is the risk that you may not get your money back. There have been many instances over the last century where countries have gone broke and had to default on their borrowings. Just because it is a government or sovereign bond does not make it risk-free.

Corporate bonds and hybrid securities

A further choice is corporate bonds, which is, in effect, lending money to companies both in Australia and overseas for longer terms, usually up to 10 years.

Companies will have to offer a higher interest rate than countries because you are taking more credit risk i.e. that the company may go broke and not repay your principal. You can reduce these risks by choosing larger, long-established companies and by having a diversified portfolio of investments to reduce exposure to any individual company going broke.

There is a variation on corporate bonds referred to as hybrid securities.

Hybrid securities pay interest like a bond but can be converted into shares in the company at a later date depending on prevailing circumstances. These are becoming more common ways of raising money, particularly for Australian banks.

Yields – another word for the interest payments on a bond – on corporate bonds average around 5 per cent but can be both lower and higher depending upon the credit risk of the company.

Property and real estate trusts

So, what other choices do we have in the search for income?

The next category is property. You can, of course, buy your own residential or commercial property and be the landlord yourself, but this means you need the resources to make such a substantial investment. The majority of investors are unable to do this and need to look for other ways to access property.

This can be done through either listed or unlisted property trusts. The property trusts that are listed on both Australian and international share markets are known as real estate investment trusts (REITs). In effect, you are buying an interest in a portfolio of properties and receive distributions of your share of the rent. The price of your units in the trust can go up or down depending on prevailing property prices.

The average yield on REIT’s in the Australian sharemarket is around 4.5 per cent. Additionally, there can be some tax advantages from these investments as sometimes only a portion of the income is taxable.

Alternative assets

I have included in the table above the category of alternative assets. These are typically investments in infrastructure such as airports, bridges, pipelines, roads and tunnels that involve massive investments, often from a combination of public and private money. These investments are normally highly illiquid and are meant to be held for the very long term. Income distributions can vary significantly.

These investments have become very popular for large Australian superannuation funds (particularly industry superannuation funds). The average investor can only access these investments indirectly through trusts. It is difficult to provide information about the average yield on these investments but it is typically higher than cash and fixed interest.

Australian shares

The next source of income in the table above is Australian shares. This is a relatively well-known asset class and delivers its income in the form of dividends. You can also be entitled to franking credits under the Australian tax system.

For a retiree who does not pay tax, these franking credits can add significantly to the return of income. For example, some of the major banks in Australia have a current dividend yield of around 6 per cent. In addition to the 6 per cent, it is possible to receive a further 2.6 per cent in a refundable tax credit, bringing the total income to 8.6 per cent. This certainly compares favourably to effectively lending to a bank at less than 2 per cent by putting your money in a term deposit or savings account.

Of course, the key issue here is the risk that prices can fall (and rise) in the future.

The average dividend yield across the Australian sharemarket is 4.5 per cent. You should appreciate that the dividend yield and tax credits for individual companies can vary substantially.

Foreign shares

The final asset in the table is international equities.

The return characteristics of shares in overseas countries is the same as Australia except for two key issues. The first is the risk of adverse movements in the currency as I described above and the second is that there are no additional tax credits available from dividends from overseas countries.

Also, on average, the dividend yield from overseas shares is significantly lower than Australian shares. This is offset by higher average growth in the value of the share. The average dividend yield overseas is currently 2 per cent – 2.5 per cent.

What is interesting to note is that the average income or yield from every asset class is higher than that available from the cash and fixed interest category where we have traditionally looked for income.

The crucial issue to be aware of is, that in searching for additional income, there is no choice but to accept additional risk.

Given that real after-tax interest rates are below zero, there is a risk anyway of sticking with cash and deposits. You can’t avoid these risks, just look to manage them.

My recommendation is to hold a diversified portfolio that includes exposure to all asset classes but be prepared to continue to hold riskier investments over the longer term to allow for the inevitable changes in prices.

Proudly Australian owned and operated

Proudly Australian owned and operated