Despite a raft of initiatives to stop scammers in their tracks, Australians still lost over $2 billion to scams in 2021 with those aged 65 and over among those reporting the highest losses.

The Australian Competition and Consumer Commission’s (ACCC) Targeting Scams report, which compiled data from Scamwatch, ReportCyber, major banks, and money remitters, and other government agencies, reported losses of almost $1.8 billion. However, given that one-third of victims do not report scams the ACCC estimates the loss to scams totalled over $2 billion.

ACCC Deputy Chair Delia Rickard said, “scammers are the most opportunistic of all criminals”.

“Scam activity continues to increase, and last year a record number of Australians lost a record amount of money,” Rickard said.

“They [scammers] pose as charities after a natural disaster, health departments during a pandemic, and love interests every day.

“The true cost of scams is more than a dollar figure as they also cause serious emotional harm to individuals, families, and businesses.”

Alarmingly figures show that the amount lost to scammers increases with age.

Over $2 billion in losses were reported to Scamwatch and other organisations in 2021, but research shows that a third of #scam victims never report it, so the true figure could be even higher. Read our latest Targeting Scams Report for more info: https://t.co/jPXjEWSKtt pic.twitter.com/baFxmjDVJc

— Scamwatch_gov_au (@Scamwatch_gov) July 3, 2022

Seniors are considered a prime target for scammers given that most older Australians have accumulated considerable money after a lifetime of work and are generally considered less tech-savvy than younger generations.

Director of AlphaClick IT Solutions, Angelo De Silva explained that “many senior citizens grew up without technology and the technology keeps growing and changing rapidly. Since millennials grew up with technology it’s very easy for them to adopt this change.”

“Without much knowledge, it’s easier for the scammers to get what they want. And also there is not much awareness available for the seniors in the medium they normally access such as the newspaper, council communities, and other places they normally read, listen and watch.”

Exacerbating this already troubling issue is the mass closure of bank branches across the country, forcing thousands to rely solely on online banking, potentially leaving the door wide open for scammers to target older Australians.

According to the Financial Sector Union (FSU), “since the beginning of 2017 the big four banks & their affiliates and other mid-size banks, have closed hundreds of branches across Australia” with “the most commonly cited reasons for closures from the banks is that their customers are moving their transactions to internet banking or ATMs and most people don’t have the inclination or the time to go to a branch.”

“There is still a very large cohort of people who want face-to-face banking services and who don’t use web banking,” the FSU said.

“Web banking is not much use if you have an unreliable service provider and your internet keeps going down. Reliable internet is still a very real issue for people in regional and remote communities. Banking alternatives such as Australia Post and Post Office agents provide a limited range of services.”

Although online banking may offer unparalleled convenience when it comes to paying bills and checking account balances, De Silva points out that “banks closing around the country leave seniors at a high risk and also helpless when they need immediate assistance.”

“If a senior citizen had to call the bank and follow the automated phone system queue, it puts them into a very uncomfortable and uneasy situation, and more than anything they will feel helpless at the time when they need real help,” De Silva said.

With online banking looking like it’s here to stay there are a number of things over 60s should be mindful of in order to protect themselves from falling victim to possible scams.

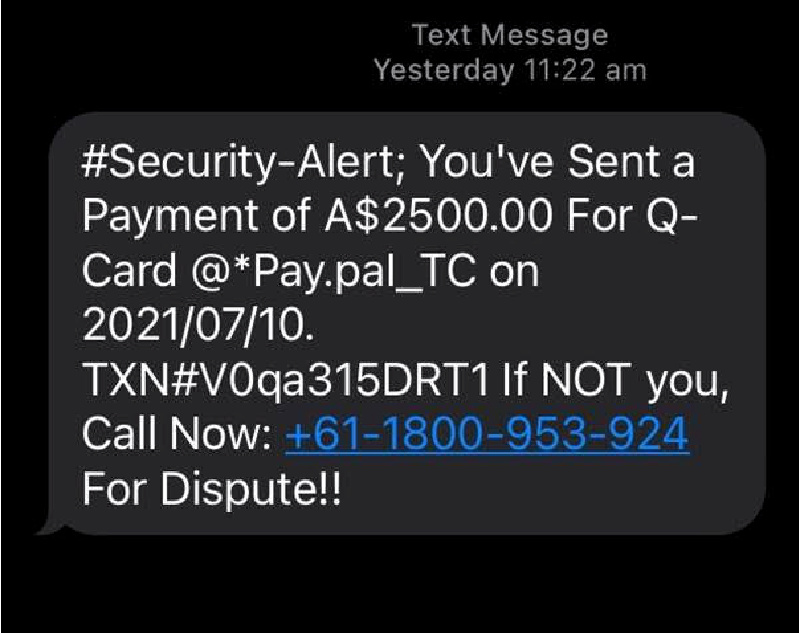

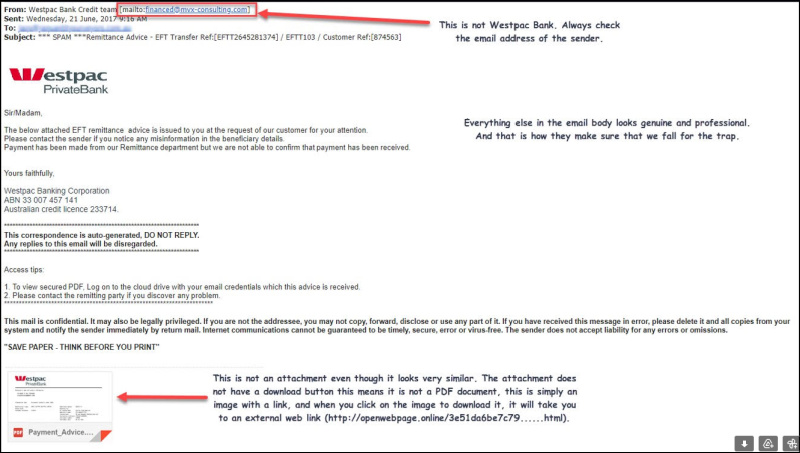

The most common manner in which a scammer will attempt to maliciously illicit personal information and funds as part of a banking-related scam will be to “get through to you via email, SMS and phone calls”, according to De Silva.

“Generally, the bank never requests you to verify the password. The links you receive via those emails and SMS are not directing you to the actual bank website, but to a web page that is designed very similarly to the banking website,” he said.

De Silva explained that the scams will often use the following terminology:

Despite online banking potentially leaving older Australians vulnerable to scams, De Silva highlights the measures banks are taking to protect their customers, which include “increasing and improving their security measures such as SMS verification for transactions, policies to protect the customers.”

However, De Silva suggests that the “most effective way” to protect older Australians from scams is through education.

“Just like everything else in life, if you do not know it’s easier for the scammers to get you. Knowing how scam SMS, emails, phone calls look and sound is the most important method of remedy,” he said.

“There are many things that can be done from the council levels and from the bank branch levels. Banks can organise their cyber security training experts to perform free training sessions for the locals to give them some confidence and knowledge.

“I personally think if the banks can find innovative and effective ways to educate their customers that would give their senior customers more confidence for the digital future.”