One of the big worries bank customers had when digital banking first emerged, back in late ‘80s, was security – how could the internet ever be as secure as a passbook taken into a branch or even a debit card in the wallet?

But the thing is, digital banking is safer than a passbook account ever was (and, as an aside, far better for protecting your health in these Covid-19 times because it negates the need to handle cash, visit a branch or find an ATM).

Along with the advent of online banking, banks introduced many layers of security to protect the accounts of digital customers. And now, using your smartphone or another device such as a tablet to access digital banking, also known as online or mobile banking, via an app adds further security still.

That doesn’t mean the door is entirely shut to scammers and fraudsters who’ve followed the money trail from branches to digital accounts. But it’s comforting to know how focused banks, such as ANZ, are on digital security. Read on to know more about the many ways your money’s protected online.

For starters, ANZ uses state-of-the-art technology called Falcon™ to monitor its customers’ digital transactions for suspicious activity, such as transactions that don’t match your habitual use of your account. If a suspicious transaction is detected, ANZ will temporarily freeze your account so any fraudster is stopped in their tracks, while the bank contacts you to verify the activity.

As a further layer of protection, ANZ may also send you a passcode by SMS so you can confirm that it is indeed you who’s making a transaction on your account, or send you an email to notify you that a transaction has been made.

To make life even more difficult for fraudsters, ANZ also encrypts the information held in its systems so your personal details and confidential banking info can’t be read by anyone unauthorised to do so. (ANZ takes the security of customers very seriously, which is why the bank encourages its customers to follow the PACT reminder to protect their virtual valuables, as we explain further below. You can also read more about PACT here.)

There’s also a time-out on ANZ’s digital banking tools, so if you accidentally walk away from a shared computer or forget to close the app on your mobile, your banking session will end, keeping your account safe from anyone who may try to access it without your knowledge.

Finally, while branches operate only during business hours, ANZ’s digital fraud detection team works 24 hours a day, seven days a week, so customers can call for help if they spot unusual activity on their account or think they’ve been subjected to a scam or fraud.

ANZ has an extra optional security app called ANZ Shield that digital banking customers can download to enable two-step verification for specific banking activities. In layman’s terms, this means that when you undertake certain transactions, you’ll be prompted to enter a one-time password sent to your mobile phone. So no one can make transactions on your account without access to both your account AND, as a second step, your phone.

You can also use the anti-virus software that you use to protect your home computer to protect your digital accounts. Click here to read more about using security software to safeguard not just your bank accounts but your personal files, photos and other important documents from the wide variety of online threats.

It’s a great idea to treat your devices like your physical valuables. Just like the keys you use to protect access to your home, a password on your computer and smart devices (tablets, phones etc) protects unwanted access to these valuable tools.

But on top of your lock code of four to six numbers, many smartphones offer the latest digital technology security features, such as iris, facial or fingerprint recognition that prevent anyone but you from unlocking the phone.

If you use the ANZ App to do your banking, you can set up a fingerprint login on your smartphone – that’s a lot harder to replicate than a password! It’s also important to know that as soon as you close the app, your banking information is removed from your device, so even if you lose your phone, it can’t be hacked to obtain historic information on your transactions.

Banks such as ANZ have teams of security experts working full-time on cybersecurity and fraud detection because fraudsters evolve their methods as quickly as technology changes.

But you also have an important role to play in protecting your own accounts, which involves being as vigilant with your digital accounts as you would with a wad of cash or your debit card in your wallet. ANZ advises checking your accounts regularly for any unusual transactions or payee names you might not recognise.

Another easy way to ensure you have tip-top protection for your digital accounts is by following four simple steps to protect your virtual valuables.

Staying up to date with trending scams is another good way of staying ahead of the fraudster’s game. Signing up for the Australian Cyber Security Centre’s alert service can ensure you’re informed on the latest scams, as well as providing you with tips and tricks on how to protect yourself against scams and frauds of all types.

As you may already know, a common tactic of scammers is to send emails, texts or make calls that purport to be from your bank and ask for personal information or passwords for your accounts or prompt you to click on links or download attachments.

Once you’re educated on the world of frauds and scams, you’ll feel much more confident about identifying such scams. But if you do find you’ve been duped, reporting it to your bank as quickly as possible is vital.

Reporting fraud is as easy as pie with ANZ, where support teams, whose sole job is to protect customers’ funds, work around the clock. And don’t worry if you’re unsure whether you were scammed or not – it’s far better to be safe than sorry, so make the call.

It’s worth noting that no bank would send an email asking for your bank account or other financial details, for personal information such as your date of birth or for log-in information for mobile or internet banking.

ANZ works around the clock to help protect your accounts from fraud and is transparent about the measures it takes to protect your money. So if you need something to put your mind at ease regarding the safety of online banking, visit ANZ’s extensive range of security information to read more about it.

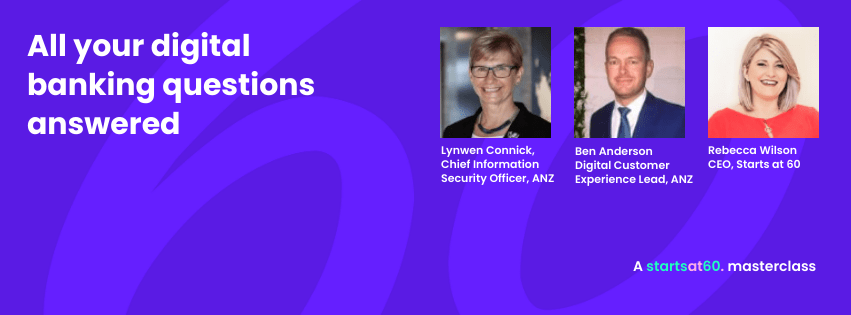

Or you can hear more about online and digital banking security from the experts when Starts at 60 founder and CEO, Rebecca Wilson, chats with ANZ’s chief information security officer, Lynwen Connick, and digital customer experience lead, Ben Anderson, on a livestream on September 4.

Rebecca will quiz the experts on your trickiest online banking and digital banking questions in this free online event, so make sure you sign up to attend.

Disclaimer: This article is by Starts at 60 and proudly sponsored by ANZ. Except where expressly stated, all views and opinions expressed in this article belong to Starts at 60 and are not the views or opinions of ANZ.

Banking on the internet or through a mobile app – is it safe? Is your information secure? What happens if you make a mistake? Starts at 60 founder Rebecca Wilson will be asking all these questions in a free live event on digital banking with some experts on digital banking and security from ANZ. Join us on 4 September 2020 at 1pm AEST!