From 1 July 2024, the income and assets test limits which are used to determine eligibility for age pension are increasing.

This means that you’re able to have a greater amount of assets and income while qualifying for at least a part age pension. Other recent changes could also improve your entitlement to the age pension if you have income from ongoing employment (such as casual or part time work), or if you have certain financial investments such as cash savings, shares, or investments in a managed fund.

If you’ve either checked your eligibility before and just missed out or if you’ve lost your entitlement because your income or assets tipped you over the cut off limits, it may be worthwhile rechecking your eligibility.

It’s also important to remember that even if you’re only eligible to receive a small or partial payment, you’ll also be entitled to the Pensioner Concession Card. This card provides a range of benefits including cheaper medication under the Pharmaceutical Benefits Scheme, bulk-billed doctors’ appointments (at the clinic’s discretion), assistance with hearing services and subsidised medical costs if you reach the Medicare Safety Net during the year.

Let’s take a closer look at what’s changing.

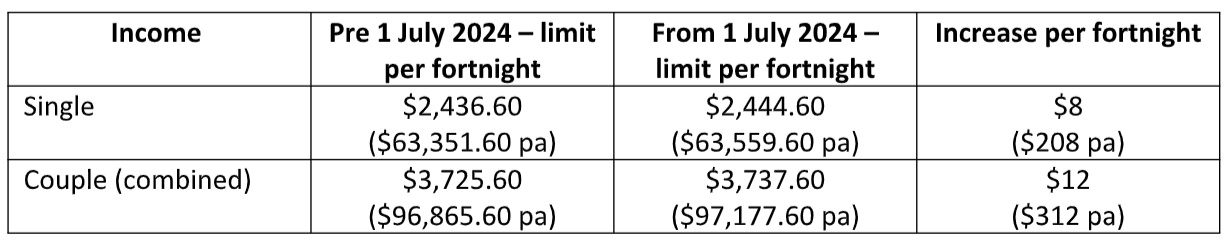

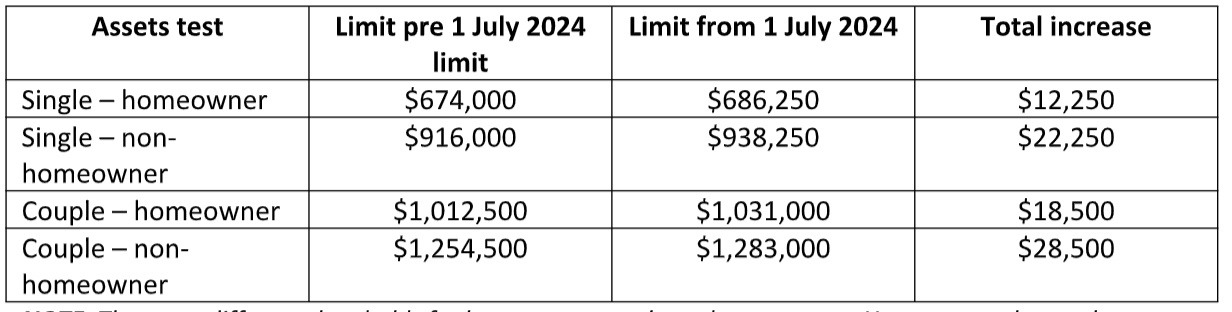

Services Australia assesses your eligibility for the age pension based on your income and assets. Income includes amounts you receive from employment, rent you receive from investment properties, and what is referred to as ‘deemed income’ from cash savings and other financial investments (we explain more about changes relating to deemed income and employment income below).

If you have a partner, their income and assets will also count when working out eligibility. Your age pension entitlement is calculated under each test, and the test which determines the lower entitlement is the amount you’ll receive.

You can have income and assets up to a certain level before your age pension entitlement is reduced from the full rate of payment. If your income or assets are above these limits, you’ll be entitled to a partial age pension payment. A higher limit applies, and if you exceed that limit, you won’t be entitled to any age pension payment. It’s these limits which increase on 1 July, and why it’s worth rechecking your eligibility.

Let’s compare the cut-out thresholds where there is no entitlement to age pension pre and post 1 July 2024:

Deeming rates are used to determine income for social security purposes assessed from certain financial investments (including bank accounts, term deposits, managed funds and shares). These rates are subject to change periodically, but the Government announced in the recent Federal Budget that the existing rates would apply through to 30 June 2025. Because the deeming rates usually trend closer to the cash rate, this is great news given the inflationary issues we are facing.

The ‘income’ calculated using the deeming rates is included when calculating eligibility for age pension under the income test. It does not matter what income is actually earned on those investments (such as interest or dividends) which could be higher than the deemed income that’s assessed.

The current deeming rates of 0.25% and 2.25% have been frozen at this level since 1 July 2022 and will be extended further until 30 June 2025. Retaining these lower rates may result in lower deemed income compared to actual income.

If you’ve reached age pension age and you’d still like to do some casual or part-time work to keep active or supplement your age pension, the Work Bonus provides an incentive to continue working by providing a concession under the income test.

Under the Work Bonus, the first $300 of fortnightly income earned from employment or self- employment is not assessed under the income test. This is in addition to the income free area explained above. Any amount of the $300 Work Bonus not used in a fortnight is added to an income bank and can be used at a later date to exclude additional from work from assessment (eg if you earn more than $300 in a fortnight).

In recent changes to the Work Bonus, new applicants will also receive a one-off $4,000 credit to their income bank, in addition to the fortnightly $300 credit. This means that if you are earning above $300 per fortnightly, the income bank is used to reduce the work income for age pension purposes, meaning you could earn more from employment without impacting your age pension entitlement. Services Australia has more information on the Work Bonus at Work Bonus – Services Australia.

Even with the changes to thresholds, some individuals will still be ineligible for age pension. However, consideration could be given to the Commonwealth Seniors Health Care Card (CSHC).

This is a concession card that provides a range of benefits including cheaper medicine under Pharmaceutical Benefits Scheme and refund of medical costs when the Medicare Safety Net is reached.

The CSHC is only income tested and the current thresholds are:

Income for CSHC purposes is ‘adjusted taxable income’ which includes:

IMPORTANT LEGAL INFO This article is of a general nature and FYI only, because it doesn’t take into account your financial or legal situation, objectives or needs. That means it’s not financial product or legal advice and shouldn’t be relied upon as if it is. Before making a financial or legal decision, you should work out if the info is appropriate for your situation and get independent, licensed financial services or legal advice.