Australia’s slowing increase in the cost of living has flowed through to a modest increase in Centrelink benefits to apply from March 20. The increase will also see thousands of wealthy Starts at 60 readers, qualify for a part-pension for the first time.

An increase in the upper cut-off thresholds for both the income and asset means test is a by-product of an increase in pension rates.

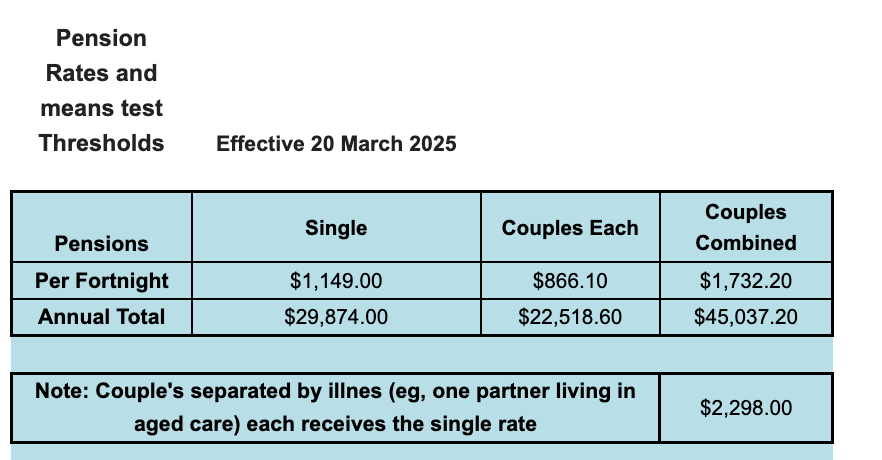

A single age pensioner will see an increase of $4.60 per fortnight to $1,149 and for couples, an increase of $3.50 each, lifts the total fortnightly payment to $866.10 or a combined $1,732.20 a fortnight.

Pensions increases are tied to one of three variables.

Age pensions must always be at least 25 percent of Male Total Average Weekly Earnings. This time, measured in November last year. That measure is compared after the increase in the Consumer Price Index and the Pensioner and Beneficiary Living Cost Index is applied to the current pension rate.

On this occasion, the 6 month CPI increase to the end of December, returned a figure of 0.4 percent and that was the number used.

An increase in the pension rate, also increases the effective cut-off levels for eligibility for a part pension.

Under a quirk in the system, people who qualify for even a tiny part pension, receive a full payment of the supplement payments which form part of the total fortnightly payment.

That means a single cannot receive anything less than $59.10 per fortnight and couples, $44.50 each or a combined $89 a fortnight.

Similarly, part-pensioners are also entitled to receive the mauve pensioner concession card which can be worth thousands of dollars in discounts on state and local government charges and services.

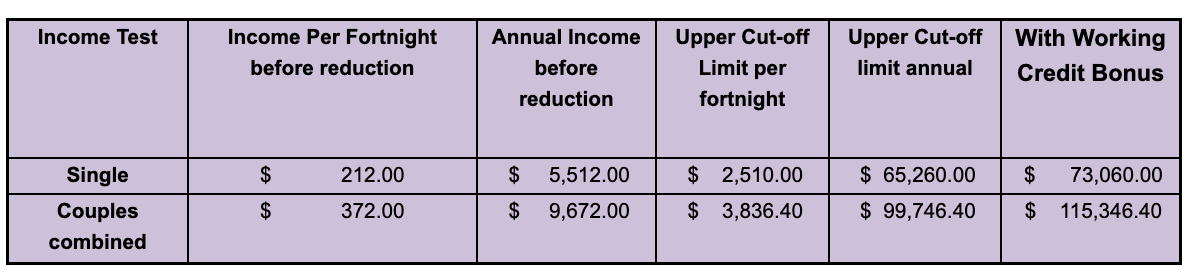

From March 20, the upper cut-off income level for a single pensioner increases to $2,510 per fortnight. This figure includes before tax employment income, foreign income, older style defined benefit superannuation pension income and the deemed income from financial investments.

For couples, the combined income cut-off limit will be $3,836.40 per fortnight.

Because Centrelink treat couples as a single entity, it doesn’t matter in who’s name the income is received.

This figure also doesn’t include the work bonus scheme where seniors can earn up to $300 per fortnight from employment before their pension is effectively reduced at the rate of 50 cents per dollar. If unused, the work bonus credit builds up each fortnight to maximum of $11,800 each. If you do some part-time work, you can use up your credit before it affects your pension payments.

For example, if you decide to work in the year’s federal election and have a working bonus credit, you probably won’t lose a cent of age pension, despite being paid hundreds of dollars.

Just note that the unused working bonus credit cannot be transferred to your partner.

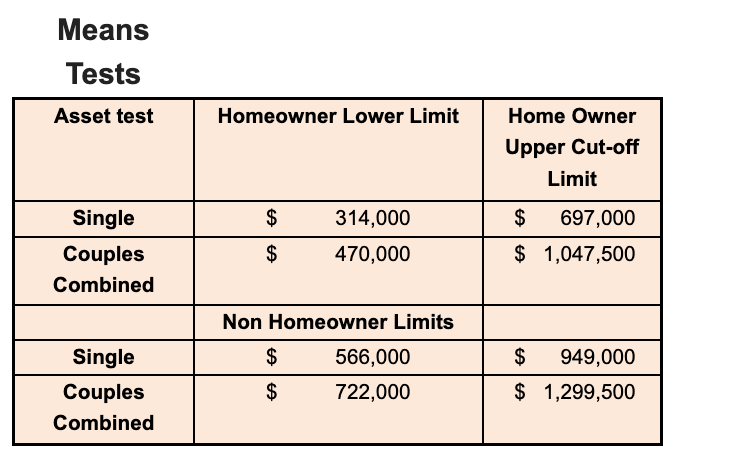

The March 20 increase also affects the upper cut-off threshold under the asset test.

A home-owning single can now have assets of $697,000 and still receive a part-pension.

Couples who own their own home can have assets of $1,047,500 and still qualify.

Remember, the value of your home on land up to 2 hectares is completely ignored. Above this land area and Centrelink attribute a value to the excess.

The only exception to this is where you have lived on a property for more than twenty years, is on a single title and its being fully utilised having regard to the land, your abilities and other factors. Only the land is exempt, stock, plant and equipment and the value of crops are not exempt.

For non home-owners, the asset test thresholds increase by $252,000.

If you think you might qualify after March 20, you can lodge your application now because you are well within 13 weeks of your eligibility date which is when you can lodge a pending application.

The easiest way for eligible Starts at 60 readers is to lodge an application via the my.gov.au website.

Source: netplan.com.au

IMPORTANT LEGAL INFO This article is of a general nature and FYI only, because it doesn’t take into account your financial or legal situation, objectives or needs. That means it’s not financial product or legal advice and shouldn’t be relied upon as if it is. Before making a financial or legal decision, you should work out if the info is appropriate for your situation and get independent, licensed financial services or legal advice.