Buying a house in 1973 versus today: A huge contrast

Remember back to your first home purchase? To the time when you bought a piece of land and a nice brick, fibro, or timber house to make way for your family to live the great Australian dream? Perhaps you had a Hills Hoist in the backyard and an outhouse too? Maybe even a picket fence.

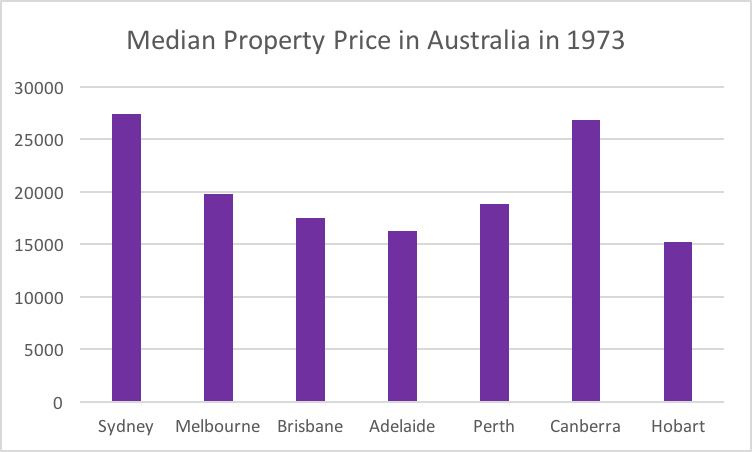

Back in 1973, the average Australian male earned approximately $8,200 per annum and the average home prices reported during the early-to-mid 1970s was $17,500-$25,000. In the 1970s banks would loan 2.5 times the total of the husband’s income, the amount they considered “reasonable” risk, so a couple looking to buy their first home were able to confidently see the ability to get a loan, and pay it back.

Today’s over-60s worked hard to buy and keep their first homes. Younger generations do too, but it is far more expensive today than it ever has been to get into the property market.

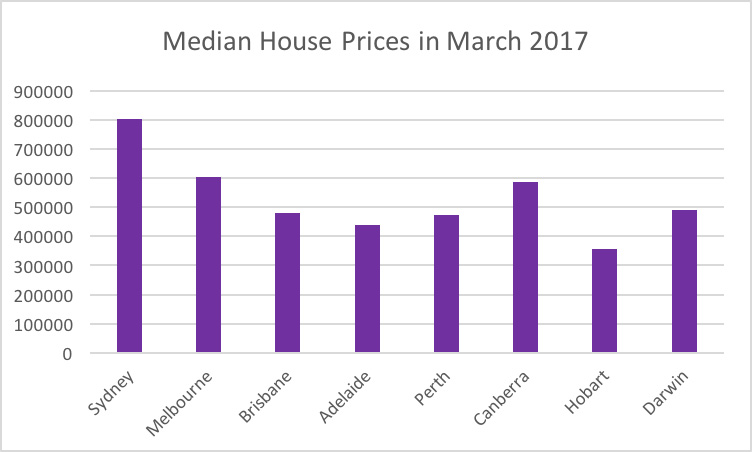

Today, the average salary for an individual (thankfully not just considered a husband anymore) is $79,870 but the average purchase price for a first home in Australia is now $570,000-plus. This is 6.9 times the salary. And banks simply won’t fund the enormous difference in multiplier between salary and value, as it places them at a much higher level of risk.

Starts at 60 community members report that in the 1970s they had to have a 33 per cent deposit to secure their first home. This would have amounted to saving approximately $5,000-$8,000 or nearly a year’s salary in total. People expected to have to do this, with only 8 per cent of Starts at 60 Baby Boomers reporting in the recent Big Money Poll that they had enjoyed help from their parents to get onto the property ladder.

Houses in the 1960s and 1970s were built for function, rather than for the high aesthetic values people aim for today, though. A new house was not uncommon, and the trend saw people enjoy a home with three bedrooms, one bathroom, and an open kitchen/meals with a separate lounge.

“In the early 70s, we had to have 33 per cent deposit,” community member Jenny said.

“We also had to have a minimum amount in an approved savings account for at least 12 months, and couldn’t commit more than 25 per cent of disposable income to mortgage repayments. In those times, you could lock in a mortgage for 25 years so you knew exactly what your commitments were.

“And interest rates were a lot higher so there was a lot more incentive to pay off the home earlier. Interest rates in the 70s were highest in mid 1975 at 10.38 per cent.”

Today, Australia’s variable home interest rates sit at around 3.75-5 per cent.

So let’s talk: What did you buy your first home for and was it affordable for you?

Proudly Australian owned and operated

Proudly Australian owned and operated