What does a transition to retirement strategy look like?

People talk about “transitioning to retirement” with a lot of hope in their voice. It is meant to be the most exciting time of your life, when you look down the barrel of the years you have been waiting for and see the day when you no longer need to turn up to work every day, instead turning up less and less, and drawing on your super more and more. But to do this you need to understand how you plan to transition to retirement and how your money can be used most effectively.

So what do people mean when they talk about a “transition to retirement strategy”? We spoke to Dean Felton from AustralianSuper to understand the important learnings.

In a superannuation sense, transition to retirement is a term usually applied to two different things:

1) Starting to use your super to draw some of your income so you can cut back on work.

Many people want, at about 60 years old, to transition to a lifestyle choice where you are cutting back on your work. Many people find that to do this they need to draw down on their super to “top up” their income to meet the desired levels of take home pay.

“First and foremost, transition to retirement is a lifestyle choice. You might decide to move from working five days per week to three or four days, giving you some freedom to care for your grandchildren, do work for a charity, or pursue a hobby you have always dreamed of. When you do this, your salary is reduced because you are doing less work,” says Dean.

So, at this point you can, as a part of your transition to retirement strategy, choose to move most your super money into an “income” account and you can draw down on that money to top up your take home pay, so you can still meet you financial needs.

Effectively, you start drawing down that extra day or two’s salary from your super funds as an income replacement.

2) Taking the very tax effective opportunity to boost the amount in your super fund through proactive, smart money management.

At the age of 56 you can start an “income” account, but at the age of 60 when you qualify to begin drawing down from your super fund, comes an unprecedented opportunity to draw on the tax free environment that is now available to you. From the age of 60, an income account suddenly attracts zero tax, so you can use it to your advantage if you are still working or generating an income.

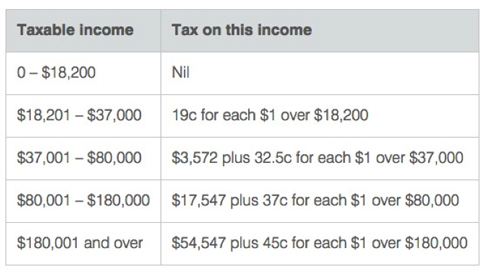

Effectively, you can start drawing your income from your super fund at zero tax, and paying your salary or wages directly into super at 15% tax, potentially significantly reducing your tax payable from the standard tax rates for individuals.

If you are working full time, when you get to 60, you can move the majority of your superannuation into an income account, and you can take advantage of salary sacrificing to put the maximum amount of $35,000 per annum directly into your fund at 15% tax.

The strategy allows you to have the same take home pay, while increasing your super. They can still spend their excess cash on expenses.

It is not for everyone. Lots of people have expenses that use up their excess cash which means they can’t afford to take advantage of the opportunity but if you can, it is certainly worth considering. It makes sense for anyone who is seeing their income impinged by the 32.5c in the dollar tax bracket (third from the bottom).

“What you are doing is putting money away using salary sacrifice at 15% tax, and drawing down on your income in a tax free environment which could mean a lower tax bracket,” says Dean.

Example

In one example, if you are on the 37% tax rate this can be a very effective strategy. Under a transition to retirement approach, you only pay 15% tax on the money you put in, up to $35,000.

So for every $100 you actually get an extra $22 to put into your super fund because you are taking advantage of the gap between 37% and 15%. And then, you can pull down $100 out of your retirement income account, to allow you to take home exactly the same amount of pay, but you are enjoying a significant tax break depending on your tax bracket.

“This strategy is especially worth considering for baby boomers that haven’t been in the superannuation system for a long time and have a big gap to make up in the last few years in the workplace. From the age of 60 this is particularly opportune,” Dean says.

“It is important to note that a strategy like this is not just for rich people. The benefit is available to anyone paying over 15% in tax. So if you haven’t explored a transition to retirement strategy, it may be worth taking the time to. Often you can get free, or very cheap advice from your super fund on this specific topic.”

Proudly Australian owned and operated

Proudly Australian owned and operated