American Baby Boomers are filing for bankruptcy at an alarming rate, with three times the number of over-65s going bust nowadays compared to the early 1990s, shocking new figures have revealed.

According to research published by the Social Science Research Network (SSRN), the number of older Americans going bankrupt has never been higher, and it’s all down to factors such as increasing medical expenses, inadequate savings and low-paying pensions, with the government offering less and less financial support.

“Older Americans report they are struggling with increased financial risks, namely inadequate income and unmanageable costs of healthcare, as they try to deal with reductions to their social safety net,” the study reads.

“Simply because of their age, this group is less able to effectively respond to the shifting risks. Unstable employment is particularly problematic for older people. When they lose jobs, it takes them significantly longer to find new ones and when they do, they typically earn less than what they earned before.”

Read more: Bankrupt parents expect daughter to fully support them when they retire.

The figures revealed that between February 2013 and November 2016 there were 3.6 bankruptcy claims filed per 1,000 people aged 65 to 74. However, 27 years ago, there were just 1.2 claims per 1,000 people in the same age bracket.

The SSRN questionnaire asked people what led them to claim bankruptcy protection, with around 60 per cent reporting that unmanageable medical expenses played a role in their dire financial situation, while two-thirds cited a drop in income and almost 75 per cent said they had been forced to cough up to debt collectors.

It also showed that, as more older people seek relief through bankruptcy, they also represent a wider proportion of all filers. Nowadays, over-65s are responsible for 12.2 per cent of all bankrupts, compared to just 2.1 per cent back in 1991.

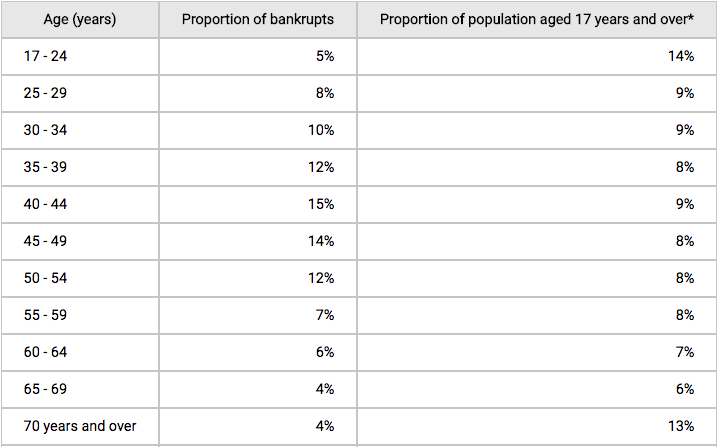

Things look more positive for Boomers here in Australia though, as the most recent figures from the Australian Financial Security Authority (AFSA) show that people aged 65 and over account for just 8 per cent of all bankrupts in 2014, whereas the highest proportion of claims come from the 40-54 age range, accounting for 41 per cent of all personal bankruptcies.

But there are some signs of debt increasingly proving problematic for older Australians – who, like US Baby Boomers, face covering increasing healthcare and living costs on a fixed income – with proportion of bankrupts in the 50-64 age group, increasing from increased from 22 per cent of the total debtor group in 2008 to 26 per cent in 2014. Aussies aged 50-54 made up the biggest increase within that older group.

But overall, older Australians tend declare bankruptcy at a lower rate than some other age groups when the proportion of the population they make up is taken into account. For example, 40-44-year-olds make up just 9 per cent of the Australian population aged 17-plus but they make up 15 per cent of all bankrupts, while people aged 70-plus make up 13 per cent of the population, yet just 4 per cent of bankrupts.