Who will benefit? Turnbull Government reveals major Budget 2016 plans…

Malcolm Turnbull and Scott Morrison have given strong hints about what to expect in tomorrow night’s budget policy.

Small-to-medium businesses and middle-class workers are set to be the big winners. However, it might not be what lower income earners want to hear.

“This is not Tony Abbott’s plan, this is the plan of the Turnbull Government,” said Mr Turnbull in a Sky News interview.

“We’re not fiddling – this is going to be a critically important economic document.”

“It is a plan to ensure jobs and growth and a sustainable tax system, and the restoration of the budget to balance, bringing those deficits down in a managed and measured way so that we … live within our means.”

Treasurer Scott Morrison told Fairfax Media that company tax will be cut to encourage new investment.

Australians earning over $80,000 will also get some modest tax cuts. However, those earning less should not expect any tax relief.

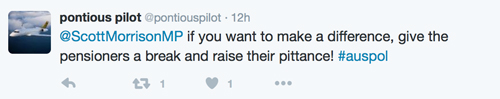

In a separate interview, he told Channel Nine these tax cuts would help “people out there earning average wages” – a comment that quickly drew criticism from social media.

Wealthier Australians will, however, be paying more tax on their superannuation.

“We’ll be ensuring that we better target the concessions that are there in superannuation, we’ve said that for some time,” said Mr Morrison.

“I don’t think there’s any great secret about that, the details of those things we’ll deal with on Tuesday night.”

“”But it’s important that we get these incentives right because superannuation is so important for Australians and for their future and we need to make sure that those concessions are well targeted.”

While the possibility of GST changes were discussed, the Prime Minister confirmed this was ultimately rule out.

“’I can give you this absolute undertaking: there will be no change to the GST in the next parliament,” said Mr Turnbull.

“I will be very, very clear about this: no government should, and frankly I don’t think any government would contemplate making a change as big as that without taking it to an election.”

Proudly Australian owned and operated

Proudly Australian owned and operated