Will your children ever afford a good house in a nice suburb?

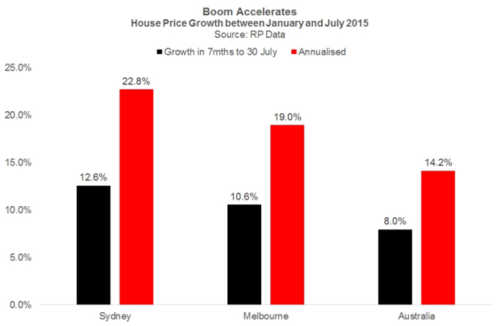

The media have yesterday declared that Australia’s property market in capital cities is hot… positively hot! 23% growth in Sydney, 19% growth in Melbourne and 14% growth nationwide over the last 7 months proves it in a very significant way, and it leaves me wondering whether you worry for your children and grandchildren’s ability to buy a house.

The median house price in Sydney is now $914,056 while Melbourne’s sits at $604,110, a far cry from the prices most Boomers bought their own houses. Looking back to 1970, the median house price in Sydney was $17,750 and in Melbourne, it was $12,670.

I travelled through Melbourne this week meeting millenials in the media industry for my work. As I travelled around telling the stories of how wonderful our readers in Starts at 60 are, many younger people cursed at the Baby Boomers who are holding onto their home through this astronomical housing boom, and investing in property with their long-gotten gains. They blamed the boomer for their inability to get into the property market. And it leads me to the question of whether you have younger people in your lives who will ever manage to get into the property market we see today?

The Australian dream is long-held. Fall in love, get married, move to a house in the suburbs and renovate it until its picket fence is white and pretty. Live there for many years until you need to upsize to accommodate the kids, renovate again, and stay there until you retire and then, either stay on forever until your family sell it out from you when you move to aged care, or increasingly, make an active and unromantic decision to downsize and move on to your retirement dream location, freeing up cash for the trips of a lifetime.

But what if our younger generations can’t enjoy this incredible experience? Is that ok? Or would you be forlorn for them?

Few people would consider house prices within or near any Australian capital city as being cheap right now. In fact, most people would consider them to be expensive, uncomfortable and perhaps inflated beyond control. Economists are concerned, the Federal Reserve is concerned and the banks are concerned too. This week we saw the banks step into action rather strongly, knowing the Reserve Bank can do little to cool a boom while consumer confidence and employment remain stressed. AMP simply declared their home lending business was closed to new customers, and ANZ, NAB and CBA all raised their interest rates on existing investment loans. In an environment where real interest rates are not really able to rise, it is an entertaining spectacle to watch consumer banks that are profit driven pull back on exposure to upside since APRA insisted they boost their core equity buffers on investment loans by up to two percent.

They don’t really want the party to stop, and we are seeing it in the fact that owner occupier lending rates are in fact dropping rates to compensate, keeping volumes up. But it begs the question…

Do you really want to leave your family home to move somewhere smaller? Or are you just happy where you are? And do you worry for your younger family members in the housing market?

How much did you pay for your first home and how old were you?

Proudly Australian owned and operated

Proudly Australian owned and operated