Corporates dodging Australian tax

Australia’s economy is struggling, reducing our tax base and causing the government to impose politically challenging cuts on individuals. Meanwhile, giant companies like BHP, Rio Tinto and News Limited are enjoying income tax loopholes that allow them to move money and assets without paying their fair share of tax here. And the Australian Tax Office and the Government aren’t happy about it. But do you think they are unhappy enough to do something that changes it?

It appears there is many loopholes that need to be closed into and out of Australia that allow companies to trade on our people, and in our country without paying tax here. In many cases the businesses may even be operating legally, within tax legislation, but because of the ageing nature of the laws in a global marketplace, Australians are being left with empty pockets.

The Australian Financial Review is this morning suggesting that BHP and Rio are redirecting their profits from iron ore through companies in Singapore where they pay no tax in Australia, and as little at 2.5 per cent tax in Singapore. The two businesses have apparently set up “marketing hubs” in the low-tax nation and are funnelling up to $2.6 billion per year through the country.

Meanwhile, Netflix has kicked off operations in Australia and are charging our residents for their TV on demand services “GST free”, and repatriating the income from subscriptions to an international business without any Australian operating vehicle. GST is not chargeable because people are not paying over $1000 and the business charging it is international.

The Government’s pursuit of the majors has been mooted for a while, with many believing it too difficult a fight for the Australian Government to take on. But this week, it is going to be front and centre of discussions. In addition to the alleged pursuit of BHP, Rio and others above, a Senate Enquiry will kick off, bringing together executives from News Limited, Google, Apple, Glencore, Rio Tinto, BHP and Fortescue.

Will they really find ways to discuss this sensitive topic and bring the money Australia should be paid back into our budgets?

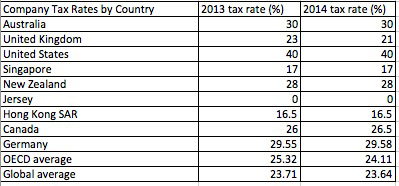

There are two sides to every argument when it comes to corporate taxes though. At 30 cents in the dollar (dropping to 28.5 this year), our tax levels are about average on the International stage but our population and position in the world is far from placing us in a position where we can demand our own way if companies are shipping monies offshore and not declaring them as Australian earned. If our Government takes too hard a stance, Australian and International businesses will simply choose to redirect their investment elsewhere, much like we saw with the Mining Tax, which seems to have been the blunt instrument that crippled further growth of our mining industry here. Can we afford this in our current rising unemployment market?

How heavily do you think our Government should pursue international businesses paying minimal tax in Australia? Is it time they went harder, or do you think they should tread carefully lest they scare off our employers?

Proudly Australian owned and operated

Proudly Australian owned and operated