Retirement villages: what do the new changes mean for you?

There’s a curious interaction between your options when you enter a retirement village, and the changes to what’s known as the asset test taper rate used to determine your age pension payments.

At the moment, every $1,000 of assets that you have above the minimum asset threshold will reduce your age pension payment by $1.50 per fortnight, but from 1 January 2017 that will move to $3.00 per fortnight.

What this means is that any impact on your assessable assets will be twice as significant as before.

Under the social security laws, a retirement village interest is considered a ‘special residence’ and your entry contribution is an asset that is exempt from the assets test, when you pay over $149,000.

This is relevant because often when you’re entering a retirement village, you will have a choice of a number of different payment options. Usually, the higher the entry contribution that you pay, the lower the departure fee that applies when you leave the village (and sometimes down to nil).

So by opting for the higher entry contribution, you reduce the amount that you have to pay later as a departure fee, and potentially increase your age pension payment as well.

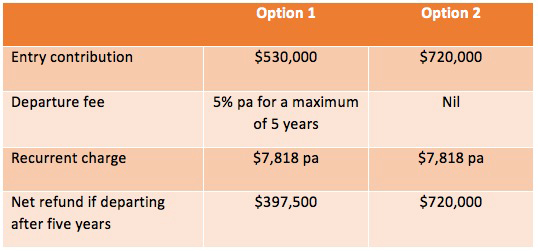

We’ve looked at one projected scenario where a couple had the following options to pay for their villa in a retirement village:

The couple were only selling their home for $450,000, so had to top up the entry contribution by withdrawing money from their super. Under the new (higher) taper rate, our estimates indicate they would be close to $150,000 better off after five years by making a bigger withdrawal from their super and paying the higher entry contribution, even when allowing for the investment returns they would no longer earn.

So it’s a really good idea to take advice if you’re looking at entering a retirement village. The numbers will change depending on your own personal assets and income, as well as the options for contributions that you’re able to negotiate with the village.

At $150,000 over 5 years – it pays to check this out first!

Any advice in this publication is of a general nature only and has not been tailored to your personal circumstances. Please seek personal advice prior to acting on this information.

Proudly Australian owned and operated

Proudly Australian owned and operated