I don’t know about you, but I have become quite judicious with who I give my information out to, particularly over the phone. I received a call the other day to my mobile, allegedly from the Queensland Chamber of Commerce (of which I am not a member) and a woman with a very foreign accent and a strange non-local phone number proceeded to launch into a request to update my contact details over the phone. My hackles went up immediately. Why would the Queensland Chamber of Commerce need to use an international call centre to update their databases by phone in this day and age? I proceeded to thank the woman and hang up. “I do not give out information over the phone, thank-you!” I said. And that is where I left it.

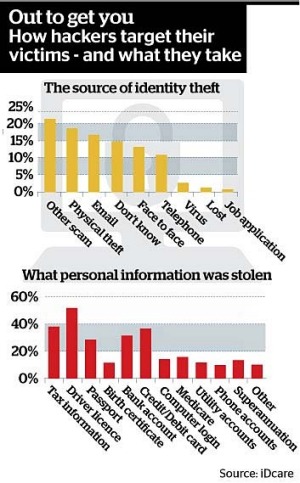

Then I trotted off to look at the latest scamwatch information only to find that there is a new level of activity in identity theft in Australia; and that is something we need to be very alert to. Cybercrime isn’t new, but it is ever-increasing; and with 36% of cybercrime victims aged between 40 and 60, and 17% of victims aged over 60 it is something we need to stand up and take notice of. And their target at the moment is perhaps not the one you might have thought of … they are looking to find ways to get into your superannuation.

Superannuation, the honey pot that is luring investors to its low-tax attractiveness, is now a target for cyber criminals it seems, and it is more important than ever that older Australians are aware of the risks of responding to an inbound call, email, or request for information from a source they don’t trust. For many here, the superannuation nest egg is the largest asset they have outside of their home. For a lot of people, it is something we set up and only check in on from time to time, and that, according to the Australian Federal Police makes it a lucrative target. The Attorney General’s department suggests that identity crime has become one of the fastest growing and most common crimes affecting Australians each year—more people report being a victim of identity crime than assault, robbery, motor vehicle theft or household break-ins.

“Superannuation Fraud is the latest earner for organised criminals who are targeting unsuspecting victims across Australia with victims remaining unaware for years that they have been duped,” said the department. Criminals are finding ways to grab identity data, then finding ways to transfer the superannuation into self managed super fund accounts or applying to the fund for hardship payments and it seems they are getting away with it a lot more than we would like to hear. It is just another kind of identity crime, but a malicious one when you think of the terrible impact it can have on someone’s life.

Whether they steal it from your mailbox, or from you directly on the phone, it gives them a starting point that it is hard to recover from.

Whether they steal it from your mailbox, or from you directly on the phone, it gives them a starting point that it is hard to recover from.

Proudly Australian owned and operated

Proudly Australian owned and operated