Don’t cut off your nose to spite your face when you maximise your pension

In my 35 years of giving financial advice, I was often confronted with theories and propositions about the best way of maximising Centrelink benefits and, in particular, the Age Pension. I recall one example where a client was advised by a neighbour to sell a commercial property worth around $500,000, which was generating a rental return of almost $50,000.

This asset and the income generated was preventing the client from getting Age Pension because of both the income and asset tests. The client was told that they should use this money to buy a more expensive home as the home is exempt from Age Pension testing. Why haven’t you suggested this strategy, my client asked me.

Well, let’s analyse it, I said. As a couple, the maximum Age Pension you can receive today is $1,282 per fortnight. This gives an annual return of $33,332. At the time I was asked this question, the maximum couple’s pension was around $26,000.

So, I asked the client whether they thought it was sensible to incur the selling and capital gains tax cost of selling a property generating an income of $50,000 in order to receive an Age Pension of half that amount.

They agreed that this would be “cutting off your nose to spite your face” and no further discussion occurred. This may be an extreme example, but I saw many instances of well-meaning advice directed at maximising Centrelink benefits actually resulting in the client being worse off as a result.

However, there are instances where sensible strategies can be applied to get the right balance between obtaining a sensible return on your investments and obtaining an entitlement to the pension.

This is particularly the case for retirees who like to hold a substantial proportion of conservative investments in vehicles such as bank accounts and term deposits. Presently, the average return on cash is 0.75 per cent and term deposits is around 1.8 per cent. At these rates, in order to replace the maximum Age Pension for a couple, you would need to invest more than $1.85 million.

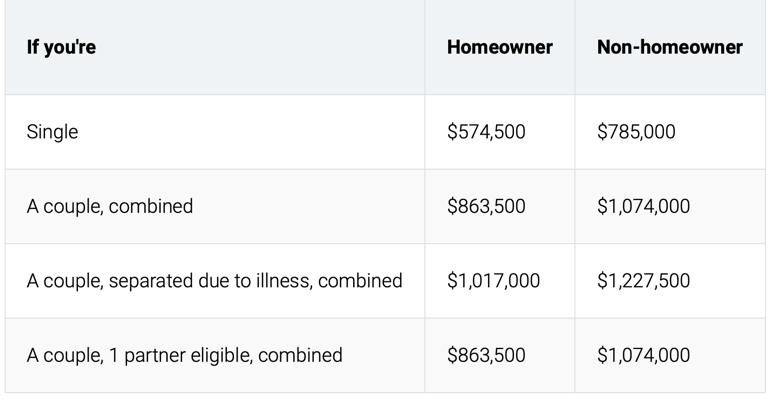

However, you will not receive any pension if your financial assets exceed those shown in the table below.

As you can see, all of these numbers are well below $1.85 million. However, in order to receive the full Age Pension, your financial assets must be equal to or below the numbers shown in the next table.

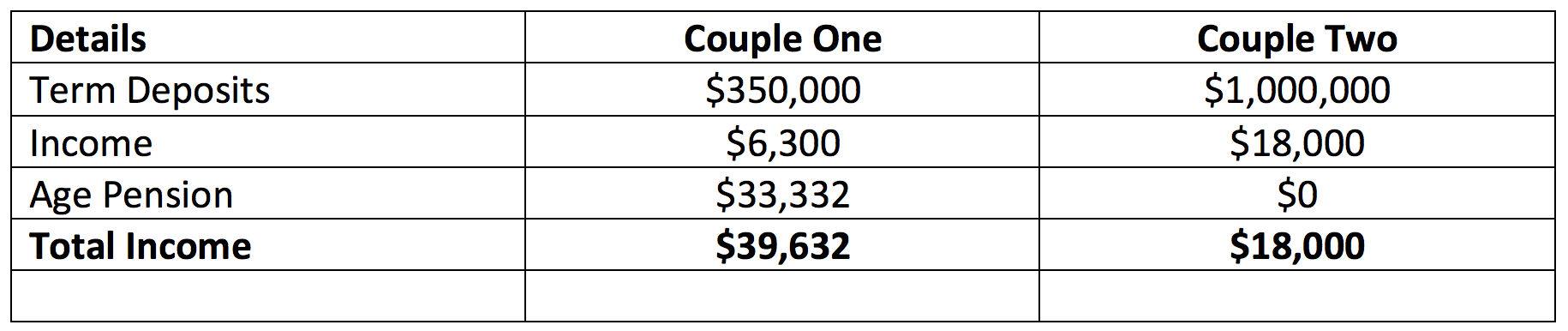

So, in effect, this means that someone at pension age with assets of more than $1 million could (on the face of it) be worse off than someone with assets worth less than $400,000, particularly if they are a conservative investor. This is because the assets of the millionaire exceed the asset test but their income from those assets may be much less than the pension received by the person with much less money.

Let’s compare the incomes of two homeowner couples at pension age with only conservative investments.

Another problem which has been recently highlighted is the use of ‘deeming’ rates by Centrelink. The following information is drawn from the Centrelink website.

Deeming is a set of rules used to work out the income created from your financial assets. It assumes these assets earn a set rate of income, no matter what they really earn. The main types of financial assets are:

- savings accounts and term deposits

- managed investments, loans and debentures

- listed shares and securities

- some income streams

- some gifts you make.

It does make sense for these rules to be used as it would be impossible for Centrelink to work out the income from the individual investments of every pensioner. According to Centrelink, the benefits of deeming are that it:

- helps keep your payments steady instead of going up and down based on the performance of your financial assets

- provides an incentive to invest, as any interest rate achieved above the deeming rates doesn’t count as income

- allows you to choose the best investments for your needs, not how they may affect your payment.

So, how does it work?

- If you’re single:

- The first $51,800 of your financial assets has the deemed rate of 1 per cent applied. Anything over $51,800 is deemed to earn 3 per cent.

- If you’re a member of a couple and at least one of you get a pension:

- The first $86,200 of your combined financial assets has the deemed rate of 1 per cent applied. Anything over $86,200 is deemed to earn 3 per cent.

There are of course problems with this system, including:

- if your financial investment has no income or earns less than the deeming rate, no adjustment is made – too bad!

- presently, almost all term deposits and bank accounts are earning significantly less than the 3 per cent deeming rate.

- sometimes it can take a considerable time for a ‘failed’ investment to be officially designated as such – in the meantime, income is still deemed.

As such, the deeming system adds more pain to the plight of the conservative investor trying to obtain Age Pension because it is impossible to obtain a rate of income above 3 per cent without taking more risk and using investments such as equities or real estate investment trusts or other riskier fixed interest investments.

So, how do you navigate through this process and obtain the right balance between maximising Centrelink entitlements and constructing the best investment portfolio? As usual, with the highly complex systems we have built in Australia for tax, superannuation and Centrelink, there is no simple answer!

The only way to come to the right result is to obtain some non-conflicted advice about your options. This advice should include testing a number of strategies to see if reducing your assets and or income to obtain more Age Pension makes you better off or worse off in the long run. The types of strategies which can be considered and tested include (not an exhaustive list):

- investing more in an exempt principal residence

- simply spending more money on holidays or other indulgences to reduce your assets below the limits shown above

- using exempt or partially exempt income streams such as annuities

- changing your investment portfolio to obtain a higher income return to compensate for the current low interest rates

- keeping money in super in the accumulation phase

- modest gifts to children

- granny flat strategies.

In my experience, conducting this balancing act of strategies invokes one of the laws of physics – “for every action there is an equal and opposite reaction”. In other words, you must be prepared to make some compromises and understand the consequences of the decision you are making both in the short term and the long term. Just obtaining an entitlement to the pension without considering the costs and consequences can result in you being much worse off over time.

It may be that you cannot get a pension at the outset but may still have an entitlement in the future. Although interest rates are very low at present, they may go up in the future and a strategy which is unable to be reversed at a later time could leave you with serious regrets.

IMPORTANT LEGAL INFO This article is of a general nature and FYI only, because it doesn’t take into account your financial or legal situation, objectives or needs. That means it’s not financial product or legal advice and shouldn’t be relied upon as if it is. Before making a financial or legal decision, you should work out if the info is appropriate for your situation and get independent, licensed financial services or legal advice.

Proudly Australian owned and operated

Proudly Australian owned and operated