New data shows frightening reliance on ‘The Bank of Mum and Dad’

When Boomers were young, a first home was bought for anywhere between $10,000 and $50,000, getting a homeowner on the property ladder for approximately 4 times their average income. Today, the median price of a house in Australia sits at $547,000, now nearly 7 times the average income of close to $80,000 per year.

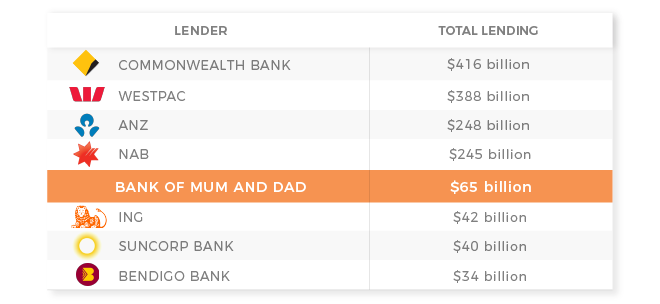

It is unsurprising to many to see that the younger generations are turning to their parents to help them get into the property market, with “The Bank of Mum and Dad” featuring fifth on the country’s banking index this week in a report released by Mozo. The Bank of Mum and Dad has loaned $65 billion dollars to young Aussie home buyers in the last year. 29% of Australian parents are now helping their children to buy a home, loaning their kids on average $64,000 and 67% don’t expect to be repaid.

Society has certainly changed to accomodate this with many younger generations relying on two incomes to service a mortgage, and often struggling to do so.

“With house prices rising out of step with income growth, many young Aussies looking to buy their first home have to be very resourceful when it comes to their finances,” said Mozo representative, Kirsty Lamont.

“Housing affordability is a mounting problem in many areas of Australia, and it’s getting harder and harder for new buyers to enter the market,” she said.

“This has lead to the rise of mum and dad as a lender – parents who are helping their kids to purchase a property by contributing to the deposit, helping to meet home loan repayments or in some cases even buying the property on their children’s behalf.”

The Bank of Mum and Dad has taken a significant leap onto the board, sitting behind ANZ, CBA, NAB and Westpac, but ahead of other major Macquarie, and smaller banks like ING and Suncorp.

The contributions parents are making in the study are both direct and indirect, with 43% of respondents offering to let their kids live at home rent free while they save for a home deposit. 41% were directly contributing to a home deposit.

How much was a home when you bought your first? And do you think it is important to help your kids get on the property ladder?

Proudly Australian owned and operated

Proudly Australian owned and operated